The Financial Crimes Enforcement Network (FinCEN), a federal agency part of the Treasury Department, has launched a website on which businesses can file a reporting declaring their beneficial ownership information (BOI).

Yes, reporting a business’s beneficial ownership is required. The authority for the Treasury Department to gather such information comes from the Information on U.S. Anti-Money Laundering and Counter-Terrorism Financing Regulations and the Corporate Transparency Act (CTA). I have seen emails about BOI, BOI reporting, and many offers to help with the reporting (for a fee, of course).

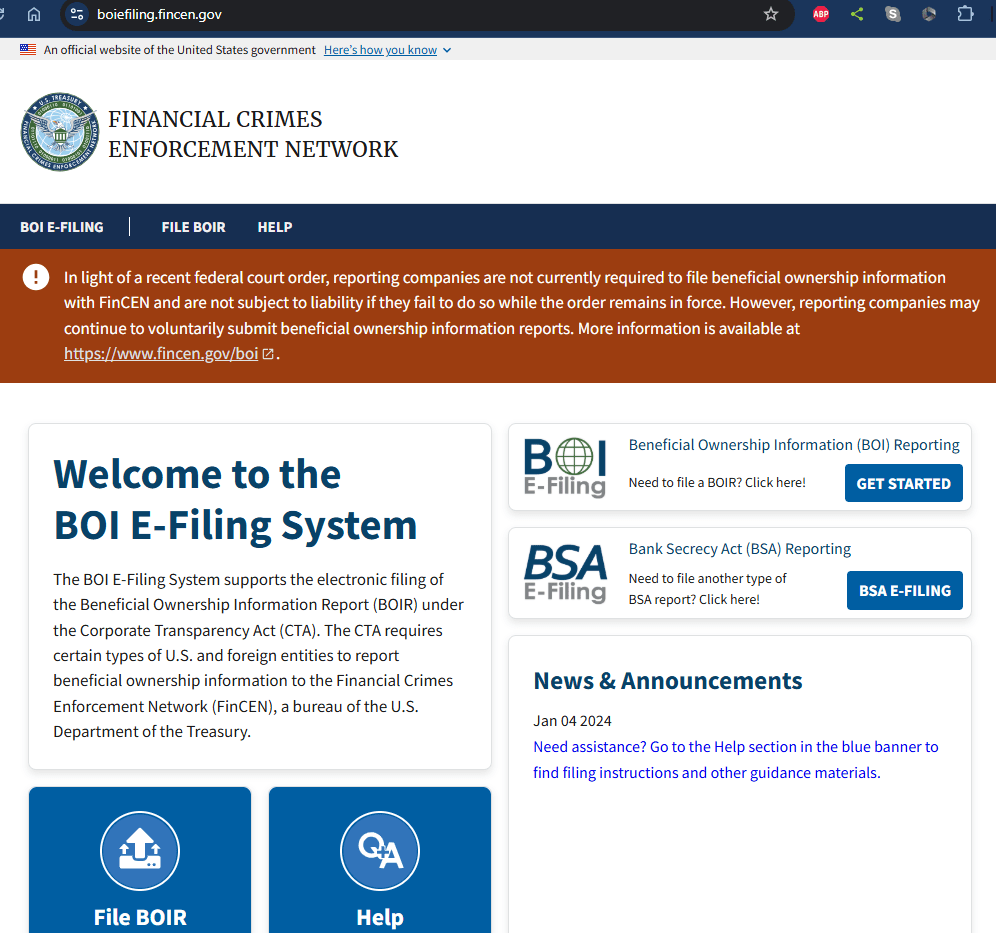

The FinCEN website is the starting point for BOI reporting: https://fincen.gov/

The initial filing deadline was 12/31/2024, but the filing requirement has been suspended based on a federal court order. This is a screen shot of the BOI efiling homepage:

If you own a business that has registered with a state as a corporation, a limited liability company, or any other type of entity, your business will be required to file its beneficial ownership information — unless something significant happens in the federal courts.

BUT, you do not have to file the BOI yet.

The federal courts could extend the filing deadline, modify the required information, or even rule the filing unconstitutional.

I suspect that the filing requirement will be upheld, at least in some form. The most burdensome aspect of the BOI filing is gathering all the information for the business’s owners:

Legal Name

Address

Date of Birth

Social Security Number

AND

Passport number

OR

Driver’s License Number

AND

AND

AND

A JPEG or PDF copy of each passport or driver’s license.

I have voluntarily filed my initial BOI and the process took about 15 minutes.

A number of bar associations around the country have issued statements that their opinion is that assisting a client with their BOI filing constitutes the unlicensed practice of law. So, I am not inclined to directly assist clients with BOI filings. Although, I have generally found that attorneys deal with financial forms (i.e. IRS or state tax forms) with something less than excellent execution.

Despite the legal profession’s attempt to monopolize the fees related to BOI filing assistance, I will gladly answer any client questions regarding the process.

Leave a comment